Thompson city council presented its proposed 2021 budget to the public in person and over Zoom April 29.

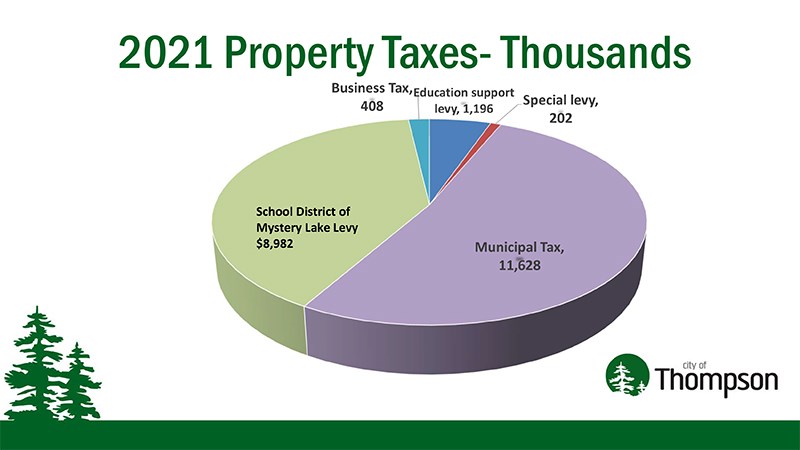

The proposed budget sets out a planned increase in the residential mill rate of two per cent and of 1.64 per cent in the commercial mill rate. The city portion of the mill rates is actually increasing by 4.79 per cent while the portion that goes to the School District of Mystery Lake went down 1.36 per cent.

For a residential property assessed at $174,680, the total taxes before the provincial education tax credit is applied will be $3,656 compared to $3,584 in 2020. For a commercial property valued at $1 million, total taxes would be $36,030 this year compared to $35,447 last year, a difference of $583.

The total city budget, if passed without changes, will be about $41 million. About 69 per cent of that is accounted for by salaries and benefits (47 per cent) and paying for RCMP services (22 per cent).

The city said in a press release that council decided to include an increase in property taxes this year in order to attempt to qualify for federal-provincial grant funding for road work and water and sewer work. Though they are still pending approval, obtaining these grants would see the city complete $5.7 million of road work with less than $1 million of city money provided and $6.8 million in water and sewer work while contributing $1.8 million of city funds. The city said in a press release that this funding may not be available in future years. If the grant money is not received, council will have to decide where to direct revenues they intend to use for their share of these capital projects.

“We hear every year that road work is an extremely high priority for our residents,” said Mayor Colleen Smook. “Road and water renewal is not a luxury, and has already been part of our capital renewal plan for years. This is an opportunity to speed up that process considerably while freeing up more resources for other community services. Since the beginning of our elected term, city council and administration have been working hard to ensure Thompsonites get more for their tax dollars. These efforts are starting to come together, and while they mean a small increase now, they’re incredibly important for the long-term health and sustainability of our community. We can’t let COVID-19 derail our future.”

If the grants are received, it would be the first time in nearly a decade that property tax dollars would be allocated to capital projects, which have been exclusively funded through reserves and provincial grants and transfers in recent years.

Smook said at the conclusion of Thursday’s meeting that it was a record audience for a financial plan presentation. Most of those who commented on the proposed budget were opposed to it.

Former councillor Ron Matechuk said the city’s residential mill rate has gone up nearly 20 per cent in three years, while Ross Martin said it wasn’t wise to increase property taxes right now.

“This is the year to keep it at zero,” he said, though he is not ideologically opposed to tax and spending increases. “For you to increase it at this time is wrong in my opinion, very wrong."

That sentiment was echoed by Harlie Pruder and Mike Lawson.

“We shouldn’t be increasing in a COVID year,” said Pruder.

“There are a lot of businesses that are hurting right now,” said Lawson, adding that the city should have reduced costs last year after the pandemic began and some facilities shut down. “I think that the city should have laid off the rec staff.”

Nelson Pruder said the city shouldn’t be increasing spending when it didn’t even spend all the money it had budgeted for last year

Council will vote on the budget and the second and possibly third reading of the levy bylaw at its next meeting May 10, five days before the budget must be submitted to the province. First reading of the levy bylaw passed by a 5-4 margin at the April 26 meeting.

The financial plan presentation slideshow is available on the city’s website. A recording of the April 29 presentation can be viewed on YouTube.