The municipal portion of property taxes is going up four per cent, the City of Thompson’s financial plan presentation unveiled at a public meeting April 25 shows, but overall taxes on a home valued at $200,000 will only be up about two per cent from last year before rebates.

Commercial property tax rates will be up 1.58 per cent overall, the presentation says.

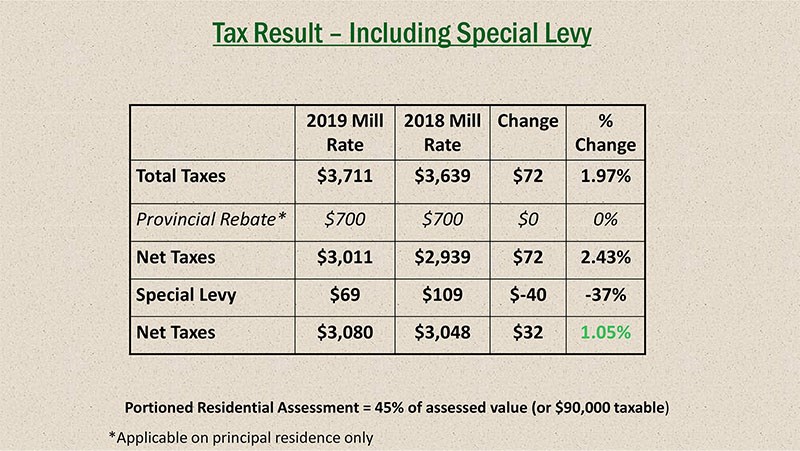

After the $700 education property tax rebate from the provincial government, which is applicable only to a principal residence, a $200,000 home will have a total tax bill of $3,080 this year, including the $69 sewer levy. That is a $32 or 1.05 per cent increase from 2018, when the tax bill would have been $3,048.

A commercial property with an assessed value of $1 million will pay $33,148 in 2019 compared to $32,631 in 2018, an overall increase of $517.

The closure of the Norplex Pool will not result in significant cost savings for the city, since staff who worked there have been reassigned to other areas. However, the city is saving money by leaving four job vacancies unfilled, and cutting seasonal public works employee hours by one-third and remaining recreation seasonal employees entirely. The city is also eliminating holiday gifts and the downtown improvement budget, reducing city clothing and professional fees budgets, and reducing recreation department contributions to Nickel Days, festive decorations, two unnamed special events, concerts in the park, the arts program, outdoor skating rink hours and Millennium Trail maintenance. It is also eliminating summer day camps, reducing front desk hours at the Thompson Regional Community centre, waiving fewer events fees, cutting one outdoor area attendant position and eliminating all meals at meetings, among other cost-cutting moves.

Total expenses and revenues in the proposed 2019 budget are $34,794,721, about $4.5 million higher than in the April 10 draft financial plan. The proposed expenditures are also significantly higher than the actual operating expenses of $28,560,670.63 in the 2018 fiscal year indicated in that draft financial plan.

More than half of the expenditures are in salaries and benefits (51 per cent) while another 20 per cent go towards paying for RCMP services.

Contributions to the Thompson Zoological Society are dropping from $60,000 in 2018 to $30,000 this year, while the Thompson Hotel Association, wihich received $400,000 from the accommodation tax in the previous budget year, is receiving nothing this year and has been instructed to use its previous year’s surplus to fund continuing operations.

An additional $742,472 from the federal gas tax is being dedicated toward water main renewal and nearly $3.5 million from the general reserve is being applied to the new wastewater treatment plant construction costs, meaning the city will have to borrow less than half of its $12,167,000 share after a $750,000 Federation of Canadian Municipalities grant and about $2.1 million being transferred from the utility reserve. As a result, frontage fees and water rate riders applied to properties and water utility customers will be reduced by about 50 per cent, from 81 cents to 39 cents per frontage foot of property and from 58 cents to 28 cents per cubic metre of water.

The special levy for storm, water and sewer service, in place from 2016 to 2020, will be reduced from about $108 per residential property last year to $69 this year. The levy amount is determined by the actual cost of repairing water and sewer line breaks on residential properties that are more than one metre from a home’s foundation.