CaNickel Mining Ltd. of Vancouver, formerly Crowflight Minerals Inc. said May 16 the junior mining company has received a stop work order from Manitoba's Workplace Safety and Health Division to cease blasting operations at the company's Bucko Lake nickel mine.

The stop work order will be in effect until all known open voids have been backfilled, an independent engineer has reviewed the current mining plan and audited mining operations over the past 12 months according to that mining plan, and the company revises the current mining plan in light of the audit and review, Dianmin Chen, director and CEO of CaNickel, said in a Marketwire press release. Marketwire is majority-owned by OMERS Private Equity headquartered in Toronto.

CaNickel "is fully co-operating with the governmental authority and is implementing measures towards lifting the stop work order," Chen said, adding that "moreover, as a consequence of weakening nickel prices and higher mining costs, experienced by the company using cut and fill mining methods, financially sustainable mining operations are not currently possible. Therefore, the company decided to also temporarily suspend its mill operations at Bucko Lake Mine. The company will continue its efforts in optimizing the mining plans with application of long hole stoping method. A feasibility study will also be carried out on the M11A project where a diamond drilling campaign has just completed. A further update will be provided when the Company can estimate the expected period of the suspension to deal with the foregoing matters."

The company said last December it had decided to scale back operations at its Bucko Lake mine, near Wabowden, due to unfavourable nickel prices.

The benchmark cash nickel price on the London Metal Exchange (LME) had fallen by the end of December last year in less than a year from about $13 per pound to around $8.50 per pound. On Wednesday nickel prices were down to about $7.65 per pound, a decline of about 41.2 per cent in around 18 months. Nickel was the second worst performing metal on the LME over the last half of 2011. Analysts attributed the drop in price to a large nickel surplus, and the ever-increasing use of nickel pig-iron (NPI) by Chinese stainless steel producers.

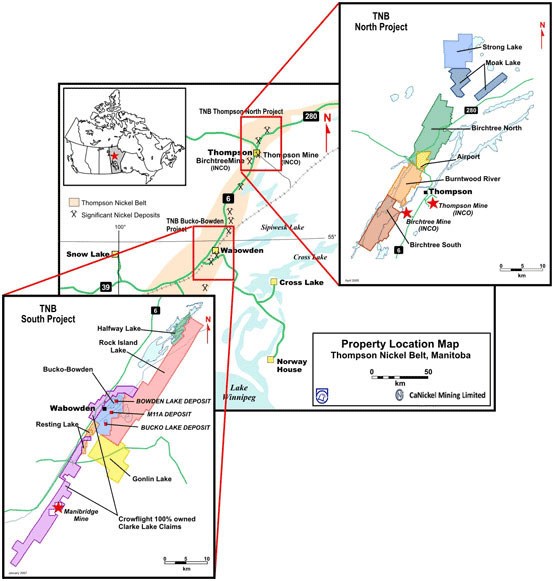

Ca Nickel bills itself as "nickel producer in Canada's most prolific nickel camps." It has the second-largest land position in the Thompson Nickel Belt, a narrow band of rock trending southwest and northeast of Thompson. It is second only to Vale operating in the Thompson Nickel Belt. In addition to the operation at the Bucko Lake Nickel Mine, CaNickel owns or has under option an additional 800 square kilometres of advanced-stage base metal exploration properties in the Thompson Nickel Belt and the Sudbury Basin in Ontario.

CaNickel Mining resumed mining operations at its Bucko Lake Mine in April 2011 after a six-month suspension of activities. The Bucko Lake mine, six kilometres south of Wabowden, was also closed earlier for three months from November 2009 to February 2010 - just after commercial production had started, resulting in the layoff of about 45 employees temporarily to complete ramp development, accelerate mine development and upgrade the backfill plant.

The company, in an attempt to address operational problems hurting its cash flow, last year shifted away from a heavy reliance on contract equipment and staffing to using more of its own equipment and people.

The mine started commercial production in the second quarter of 2009 and was estimated to contain proven and probable nickel reserves of 3.7 million tons.

CaNickel Mining entered into a joint venture agreement with Falconbridge in June 2004 for the exploration and development of the Bucko Lake deposit. Field activities then began in late 2004.Under the terms of its earn-in agreement with Falconbridge, CaNickel Mining can earn up to a 100 per cent interest in a 5.5 square kilometre area contained within Mining Lease (ML) 031 (including the Bucko Deposit Resource Block - the area containing the current resources defined within the deposit).

Consolidated Marbenor Mines Limited originally acquired the property contained within ML 031 in 1959. In 1962, diamond drilling intersected 1.54 per cent nickel over 6.34 metres in hole M77-B (the discovery hole) and soon thereafter the property was optioned to Falconbridge.

Falconbridge first discovered the Bucko Lake mineralization in 1964. Additional drilling was conducted in the 1970s and a shaft was sunk. By the time, Crowflight Minerals became involved in the project, 143 holes had been drilled.

CaNickel 100 per cent interest in Bucko Lake Mine was acquired from Xstrata Nickel in 2007. Pursuant to the transfer agreement, sales agreements and subsequent amendments to those agreements:

- Xstrata retains a back-in right to back in 50 per cent interest in and to become the operator of Bucko Lake Mine by paying to the company an amount equal to the aggregate of all direct expenditures which were incurred by the company in carrying out the mining operation at Bucko Lake Mine prior to the date of exercise of the back-in right;

- Xstrata is entitled to a 2.5% net smelter royalties;

- Upon commercial production (declared in June 2009), a royalty payment of $500,000 is payable to Xstrata;

- Xstrata will purchase 100 percent of the nickel concentrates at commercially competitive terms over the life of Bucko Lake Mine.

CaNickel's interest in the Bucko Lake mining lease is subject to a back-in right held by Xstrata. In the event that the company identifies a new deposit (in addition to the Bucko Lake Mine) with estimated measured and indicated resources in excess of 200,000,000 pounds of Nickel, Xstrata has the right to purchase a 50 per cent interest in the property and to become the operator of the new deposit in consideration for a payment to the company of an amount equal to the aggregate of all direct expenditures that were incurred by the company in carrying out mining operations on the Bucko Lake lease outside of the Bucko resource block prior to the date of exercise of the back-in right.

Accordingly, the potential benefit to CaNickel of any discovery of a significantly increased deposit will be limited to a 50 per cent interest in the project.